When considering FTSE 100 stocks, some investors might immediately think of centuries-old banks and miners. Of course, there’s good reason for that. The Footsie contains illustrious financial institutions like HSBC and Barclays, as well as mega-miners such as BHP and Rio Tinto.

But that’s only half the story. There are many other top-notch companies with a worldwide presence in quite different sectors. Here are two such stocks.

Defence giant

BAE Systems (LSE: BA.) is the one of the largest defence companies in the world. It has significant operations in the US, UK, Saudi Arabia and Australia, as well as an established presence in many other international markets.

The stock has surged over the last 14 months due to an increase in global military spending brought about by the terrible war in Ukraine.

In fact, after rising 55%, it was the best-performing stock in the FTSE 100 last year.

However, the shares are still relatively cheap, trading on a forward price-to-earnings (P/E) ratio of 17.2. That’s less than the industry average forward P/E of 20.5.

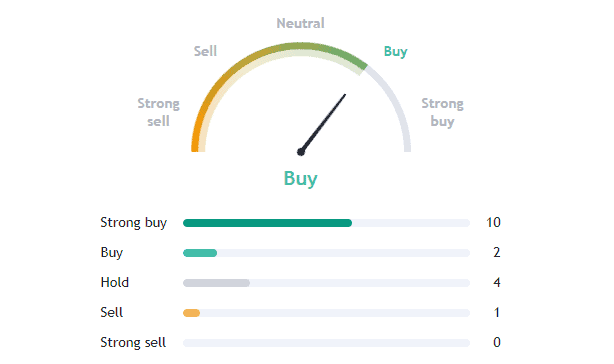

This may explain why more than half of the 17 analysts who covered the stock in the last three months rate it as a strong buy.

The shares would presumably take a hit if governments reverse their commitment to spend more on defence. But BAE already had an order backlog of nearly £60bn at the end of last year. And considering the ongoing geopolitical tensions, sales could increase for many years.

I’d start a position in this defence stock today if I didn’t already own it.

Data giant

RELX (LSE: REL) is a global provider of data analytical tools for companies and professionals in over 180 countries. Its four business segments serve numerous industries:

- Scientific, Technical & Medical

- Risk & Business Analytics

- Legal

- Exhibitions

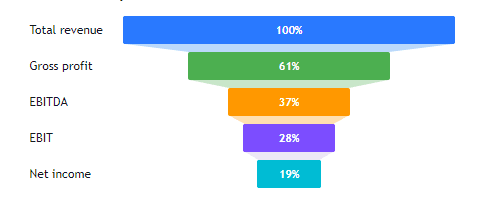

Over half of its business is subscription-based. This recurring revenue is predictable, leading to very stable and healthy profit margins.

Last month, the company reaffirmed its outlook for the current financial year. That would result in net profit of just over £2bn on revenue of £9.2bn, which are clearly impressive figures.

RELX also offers a modest dividend yielding 2%, but the payout has been growing in recent years. Considering its large profits, I expect the dividend to increase nicely in future, though that’s not a given.

One thing worth noting here though is valuation. The stock has a forward P/E in the low 20s. That’s well above the market average, so that’s a risk.

However, it hasn’t deterred star fund manager Nick Train from making the stock his top portfolio holding in Finsbury Growth & Income Trust. He said: “We continue to regard RELX as one of the most attractive growth companies in the world, let alone the UK.”

This is a company I’ve long admired. In fact, I was impressed to learn a few months ago that RELX’s academic publishing division publishes 18% of global research articles and 27% of all citations.

To be honest, I’m surprised this stock isn’t already in my portfolio! I think the firm’s vast trove of data and analytics tools will become increasingly valuable as the digital revolution accelerates.

So I’m going to finally buy the stock at some point soon.